Muva Network

Product

Fintech, Crypto

Skills

Product Design, User Research, Design Systems, Prototyping

Platform

Website, Mobile App (iOS & Android)

Tools

Figma, Framer

Date/Timeline

November 2022

VIEW LIVE

Summary

Muva Network is a specialised fintech platform designed to bring trust and simplicity to the cryptocurrency market in Nigeria. Unlike general exchanges that flood users with thousands of speculative assets, Muva focuses exclusively on "Authentic Assets"—top-tier cryptocurrencies and stablecoins. The app bridges the gap between traditional Nigerian banking (NGN) and the digital asset world, prioritising regulatory compliance, security, and ease of use.

The Problem

The cryptocurrency landscape in Nigeria and broader Africa is often characterised by:

Trust Deficit: Users frequently fall victim to scam projects, "rug pulls," and volatile meme coins due to a lack of curation on major exchanges.

Regulatory Friction: Many platforms lack proper integration with local identity systems (BVN/NIN), leading to sudden account freezes or compliance issues.

Complex Interfaces: Professional trading terminals are often too complex for users who simply want to store wealth or make payments in stablecoins.

On/Off-Ramp Difficulty: Moving money between Nigerian bank accounts and crypto wallets is often slow, expensive, or unreliable.

The Solution

We designed Muva Network to be a "Sanctuary of Authenticity." By strictly curating the asset list and integrating a robust, localised KYC process, we created a platform that feels like a digital bank.

Key Solutions:

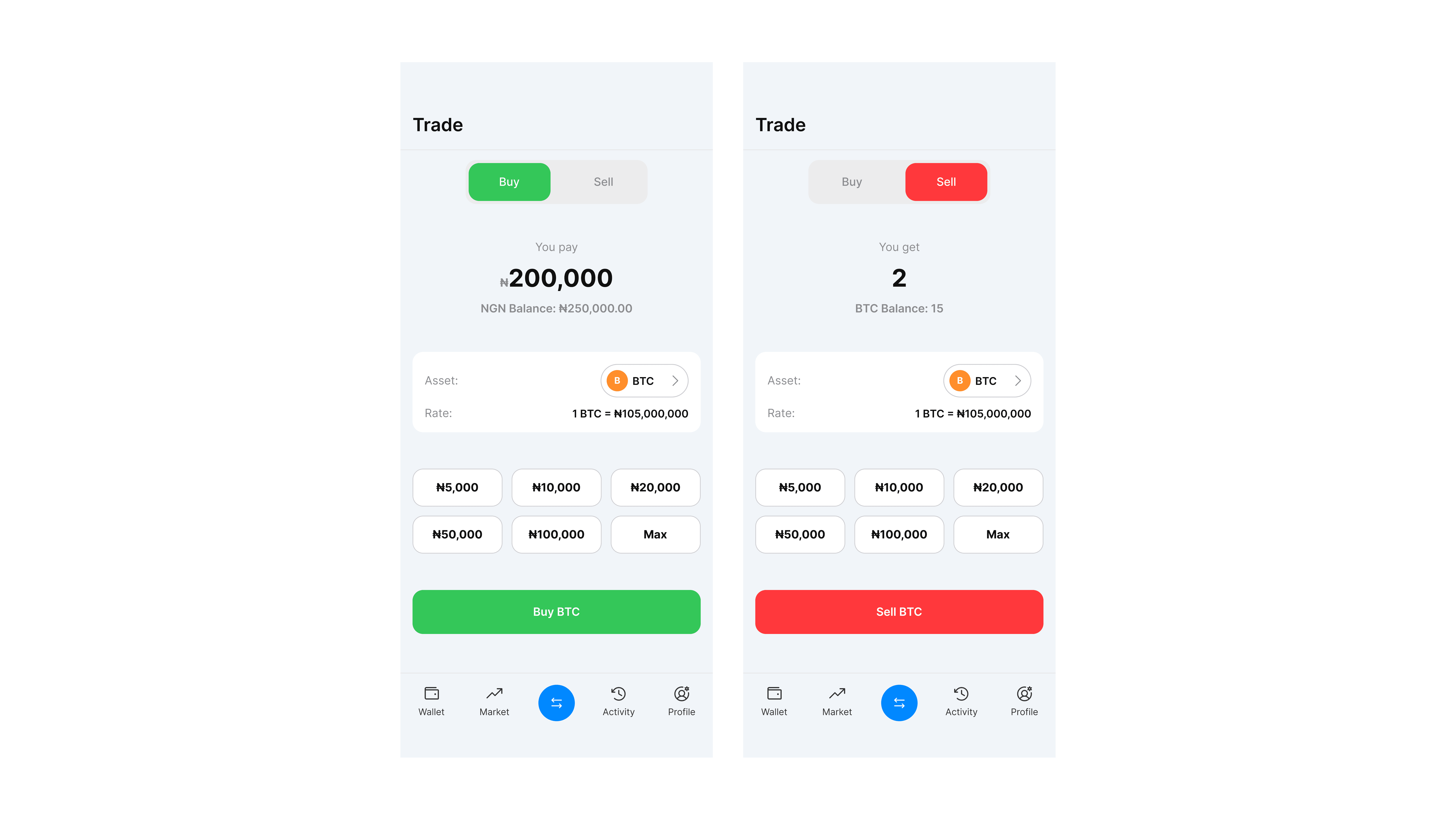

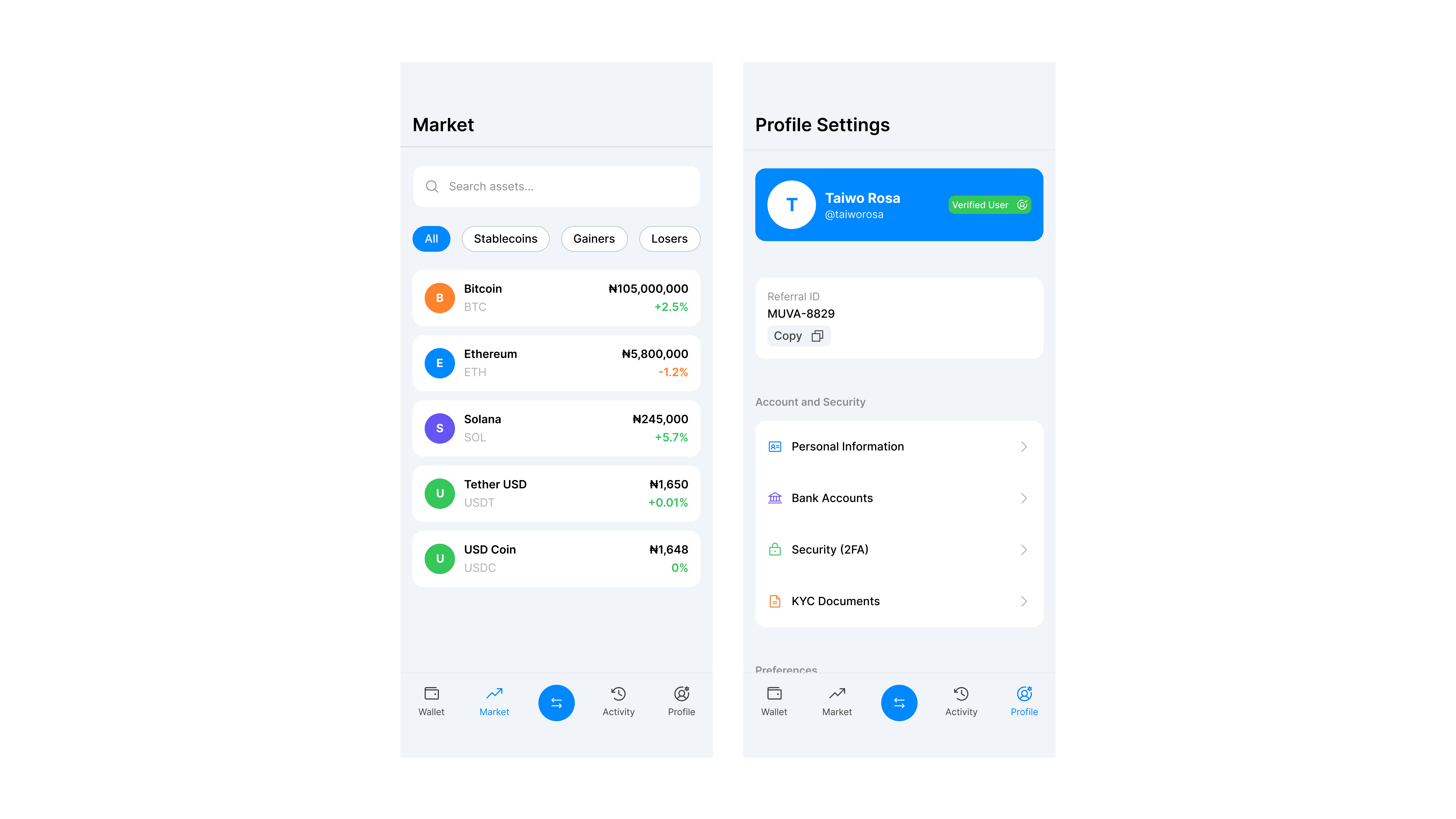

Curated Market: Access is limited to high-cap, verified assets (BTC, ETH, SOL) and stablecoins (USDT, USDC), removing decision paralysis and risk for conservative investors.

Localised Compliance: A seamless KYC flow integrating BVN (Bank Verification Number) and NIN (National Identity Number) ensures full regulatory adherence without sacrificing user experience.

Direct Fiat Integration: Native NGN wallets allow users to deposit and withdraw directly to local banks instantly.

Calm UI: A clean, light-mode interface that uses whitespace and reassuring colours to reduce anxiety during financial transactions.

Design System & Visual Identity

Color Palette

We moved away from the "dark mode gamer" aesthetic typical of crypto apps to a clean, fintech-oriented light theme.

Primary Blue (

#2563EB): Represents trust, stability, and intelligence. Used for primary actions and active states.Slate/Navy (

#0F172A): Used for text and strong structural elements to provide contrast.Backgrounds: Crisp White (

#FFFFFF) and Soft Slate (#F8FAFC) to maintain a clean, breathable layout.

Typography

Inter was selected for its geometric simplicity and high legibility, ensuring numbers and financial data are easy to scan.

Screen Breakdown & User Flow

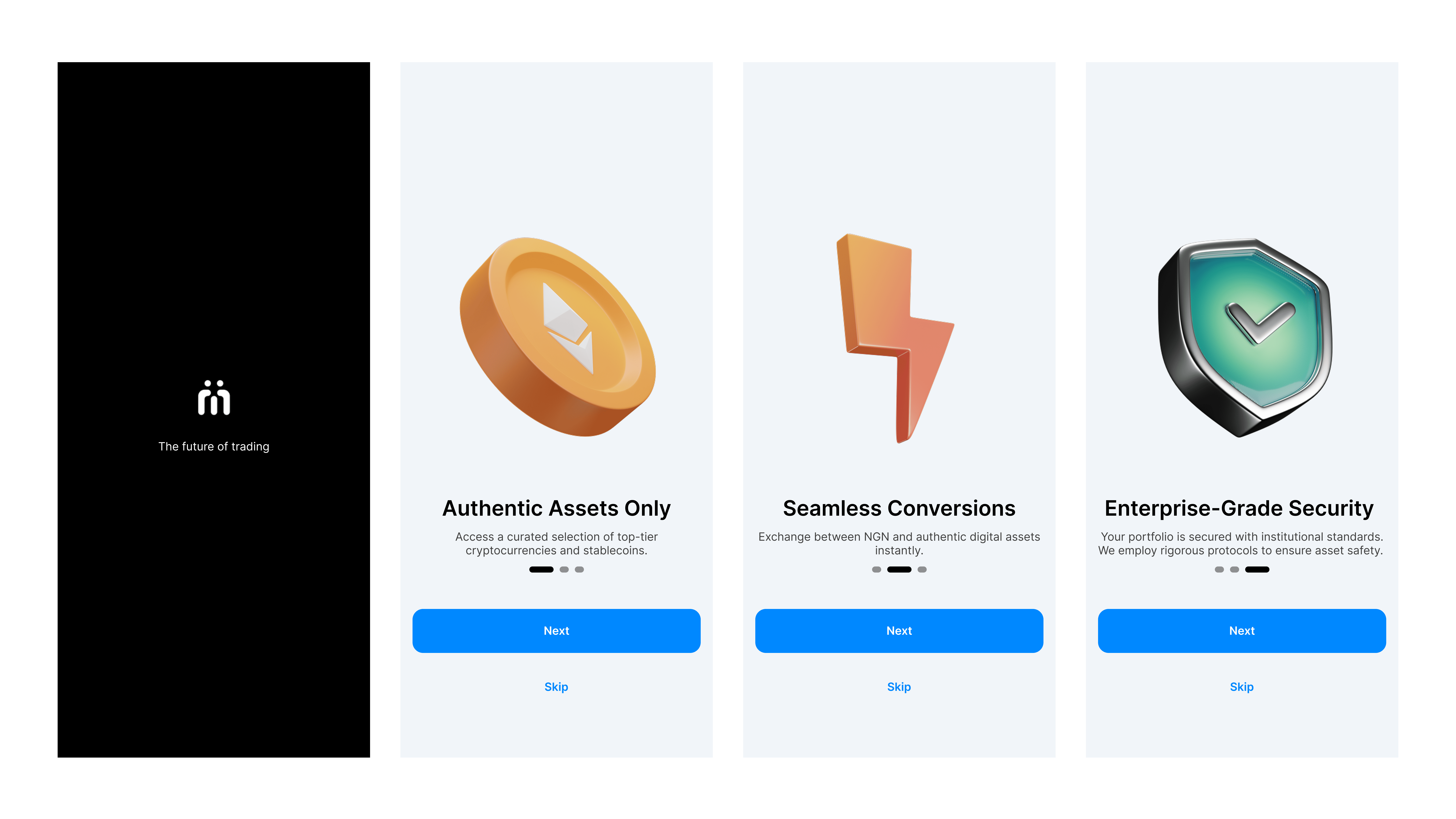

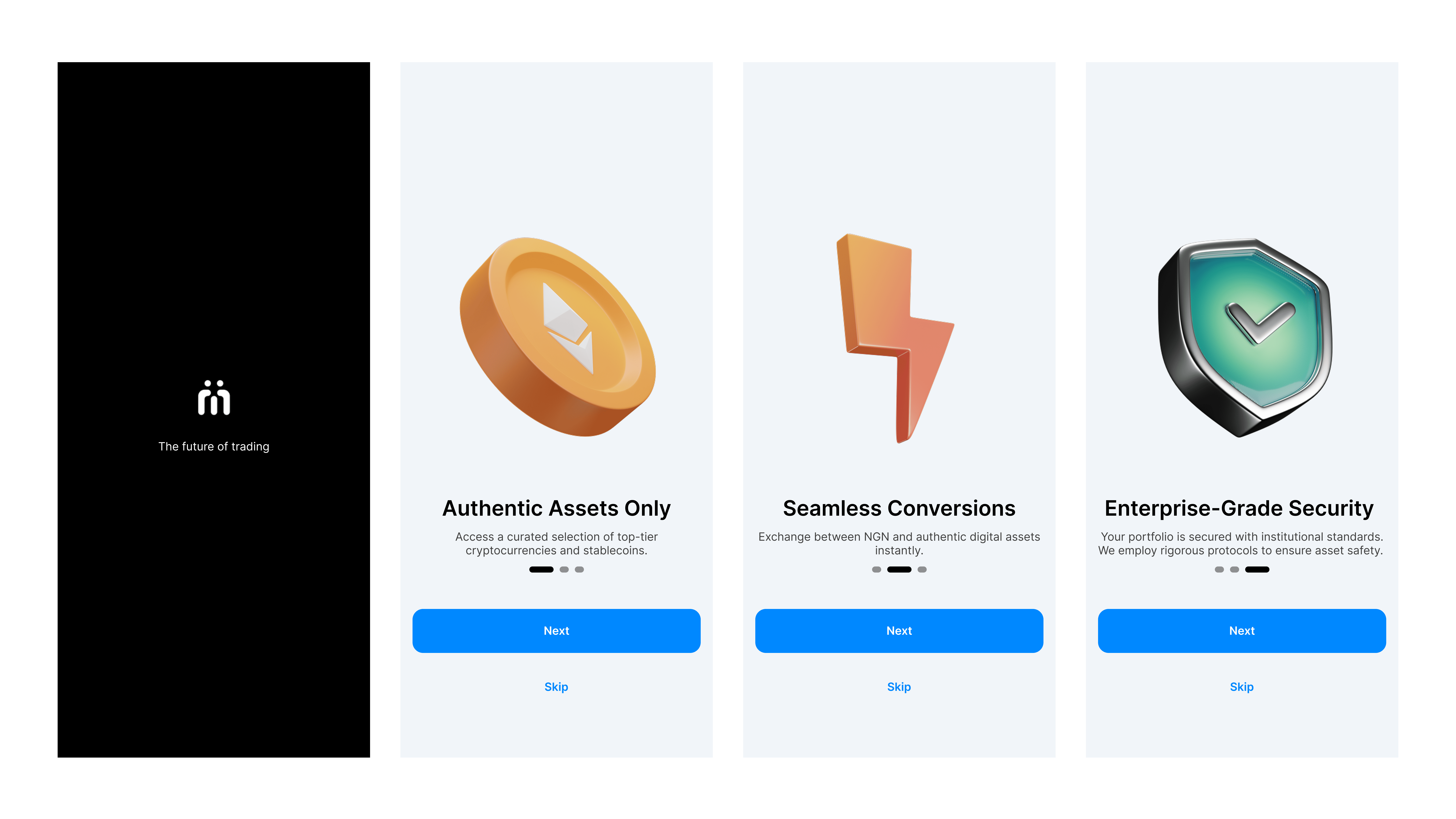

A. Splash & Onboarding

Goal: Establish immediate trust and clarify the platform's unique value proposition.

Design: A minimalist splash screen transitions into a carousel, emphasising three core pillars:

Authentic Assets Only: Setting expectations about the curated nature of the platform.

Seamless Conversions: Highlighting the ease of NGN <-> Crypto swaps.

Enterprise-Grade Security: Reassuring users about asset safety.

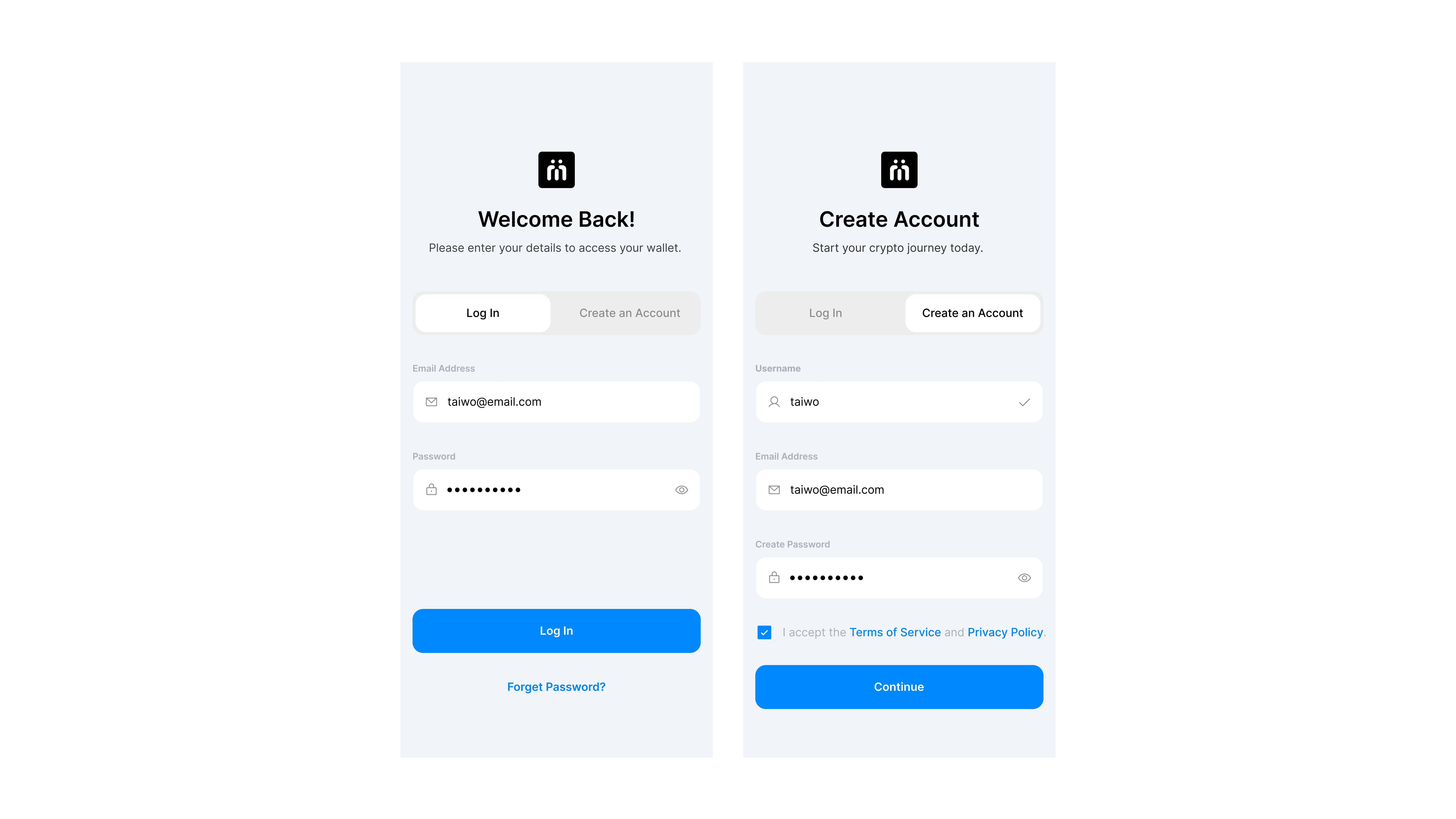

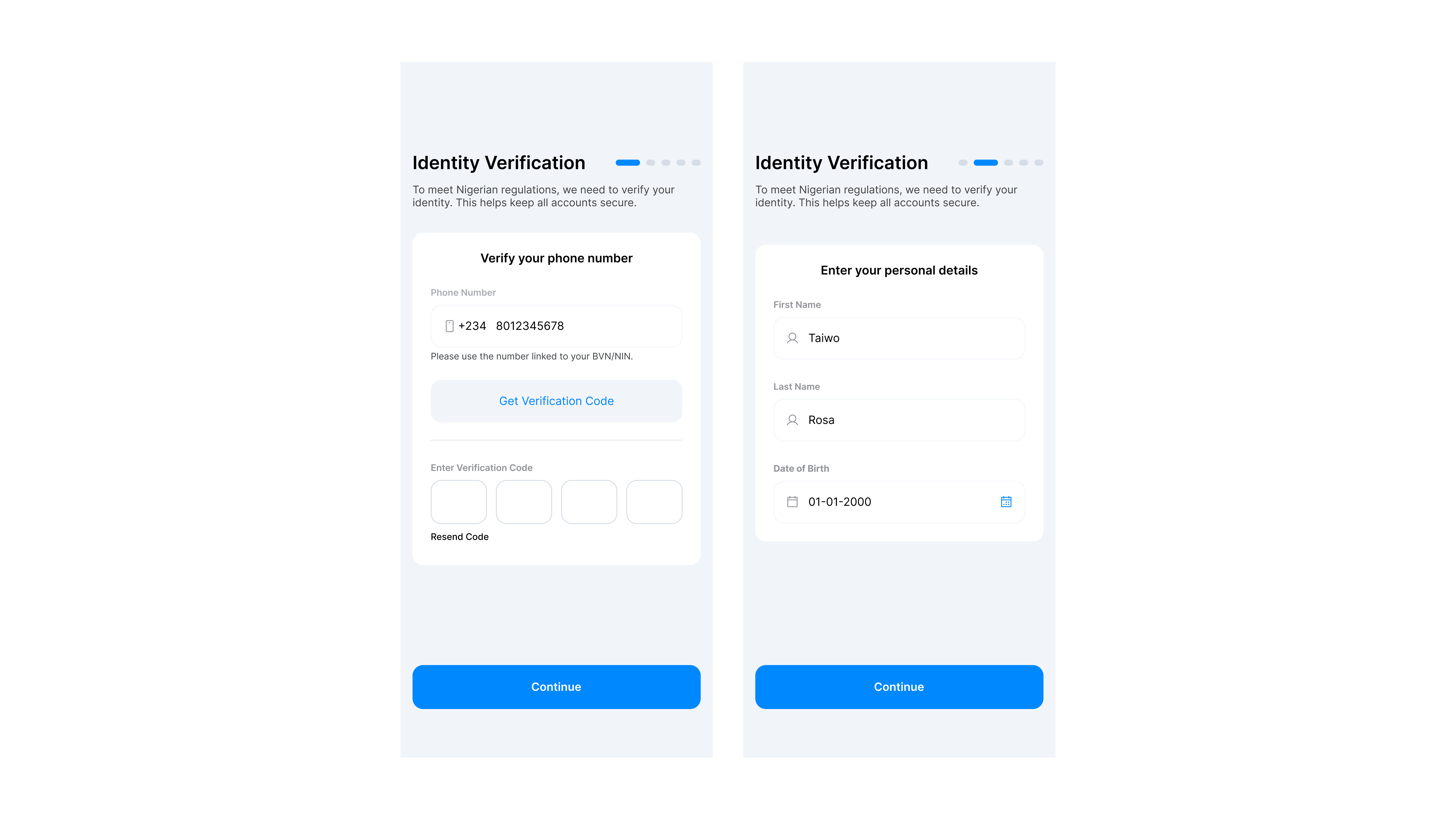

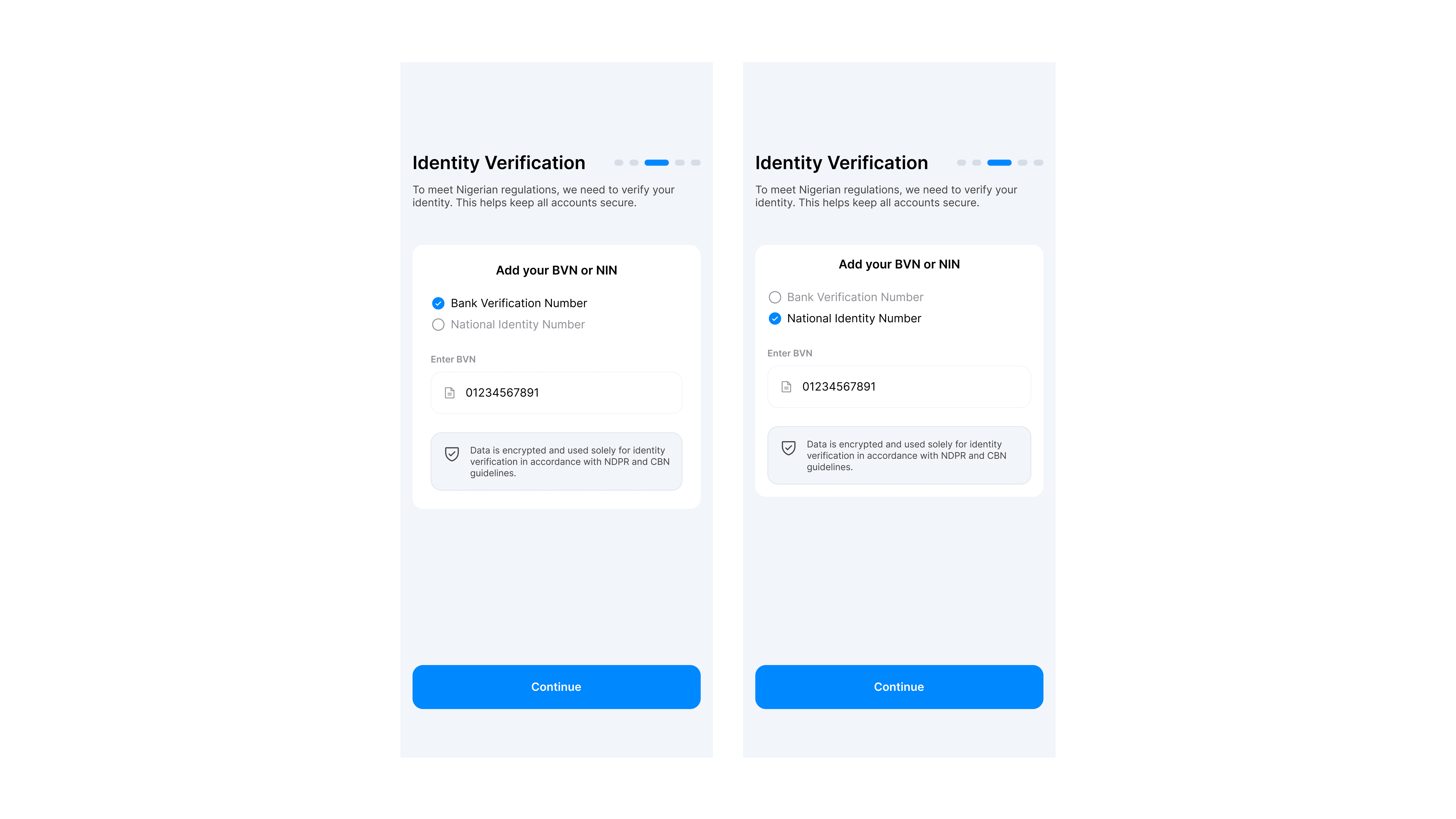

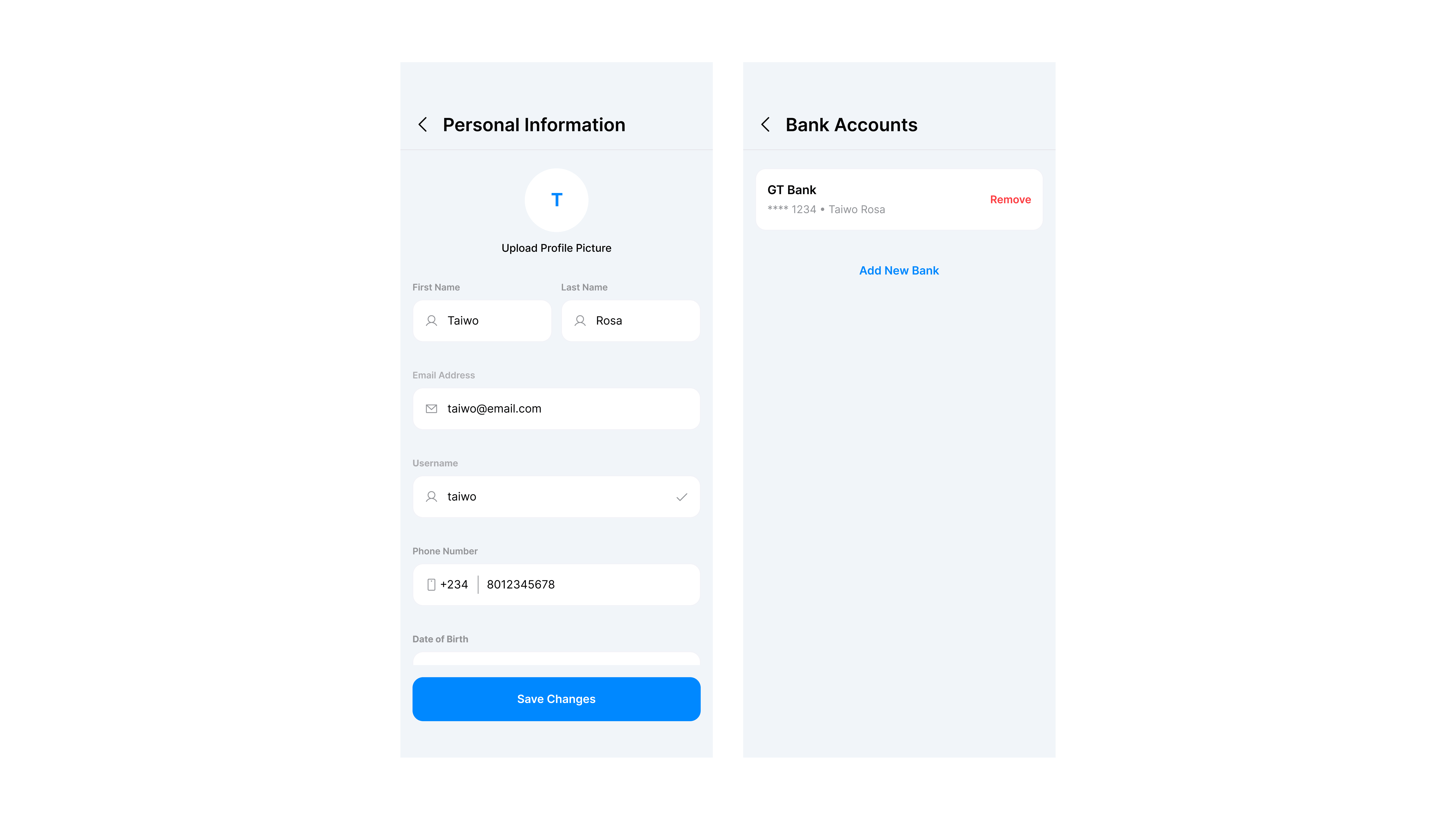

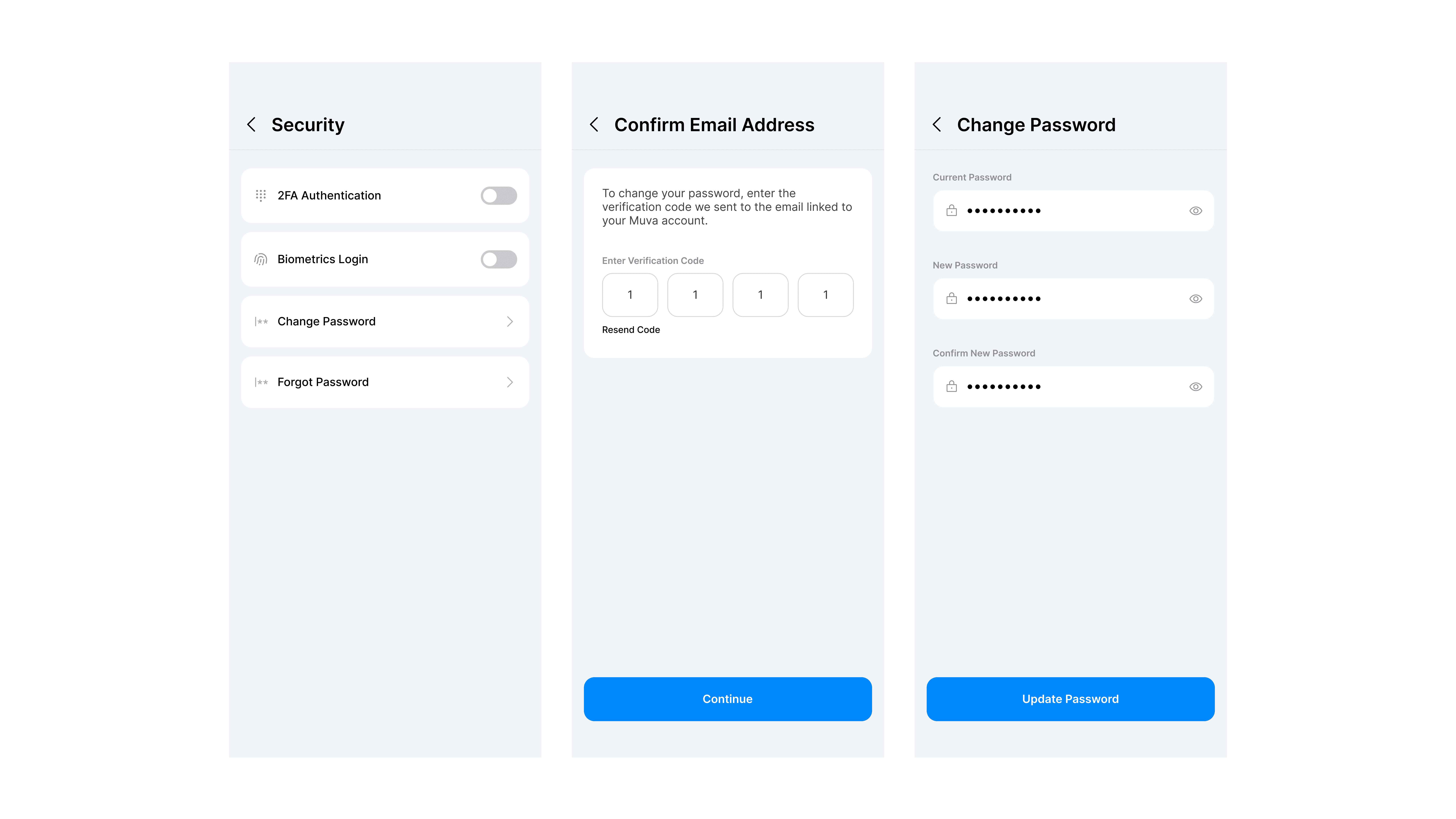

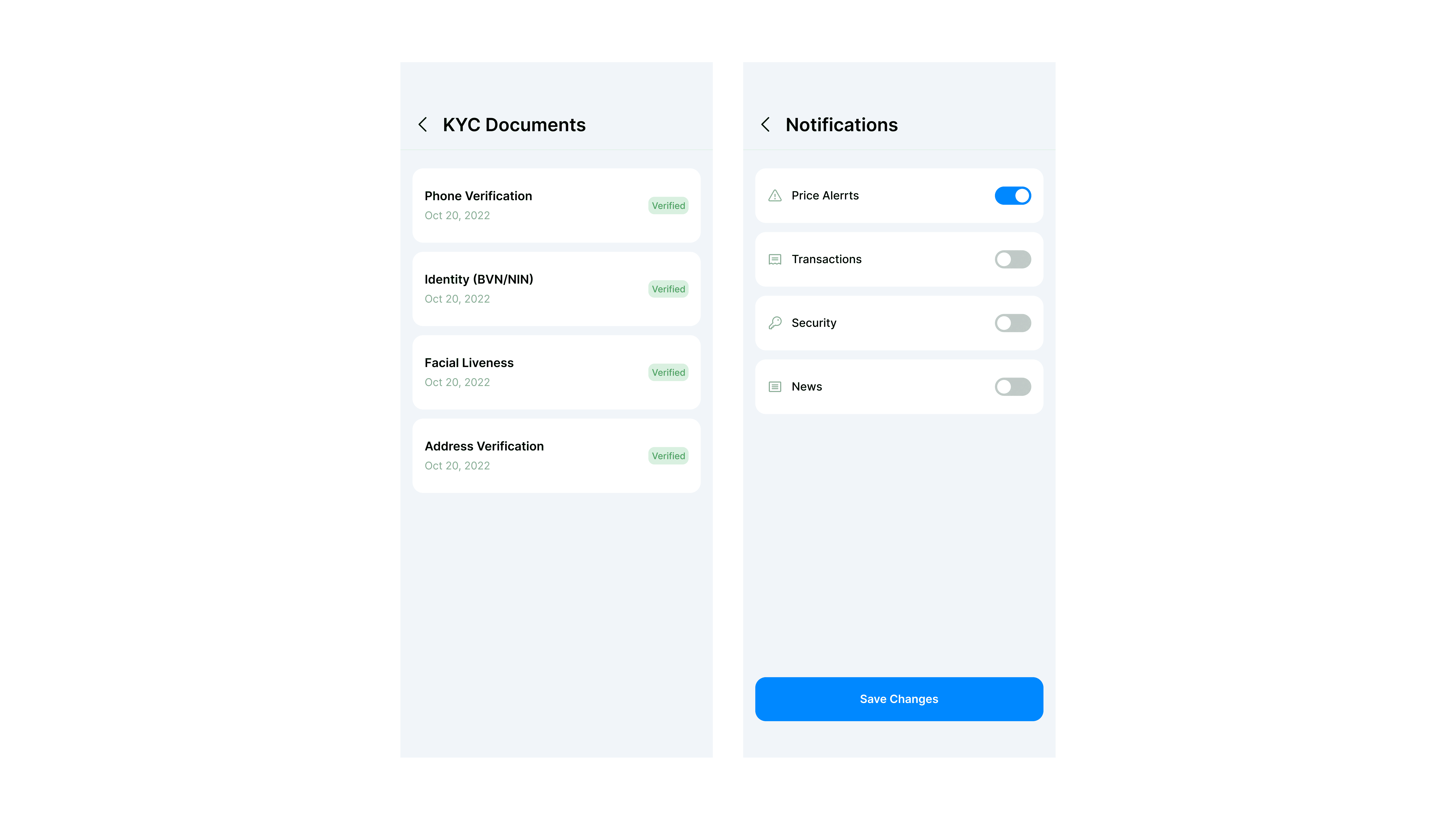

B. Authentication & KYC (Nigeria Tailored)

Goal: strict compliance with zero friction.

Sign Up: Simplified account creation requiring only essential details (Username, Email).

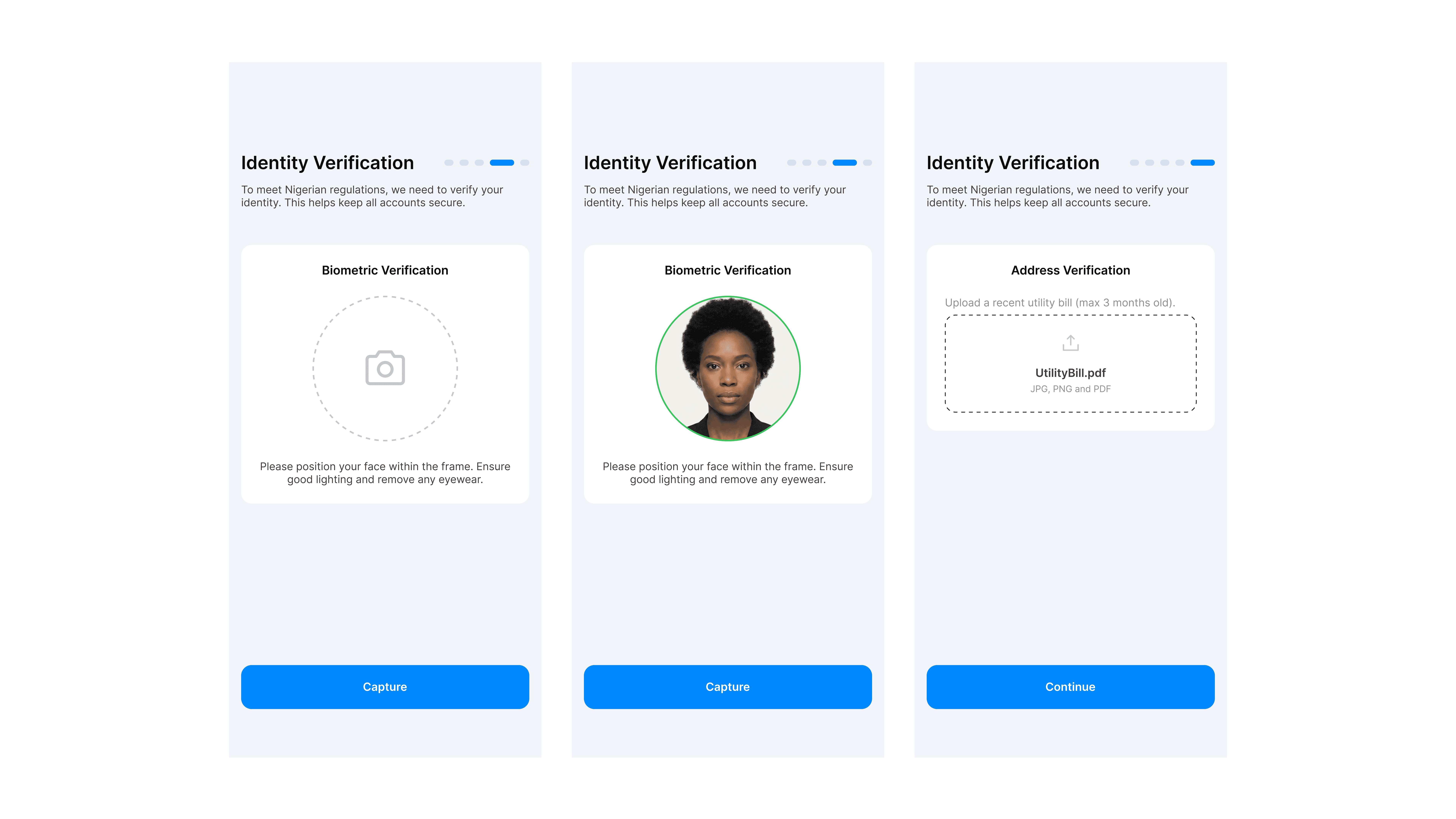

Progressive KYC: Immediately after signup, users are guided through a 4-step verification process tailored for Nigeria:

Phone Verification: OTP validation.

Identity: Integration with government databases via BVN or NIN.

Liveness Check: Biometric facial scan to prevent fraud.

Address: Utility bill upload for higher tier limits.

Feedback: Real-time validation and success screens ("Tier 2 Verified") give users immediate gratification.

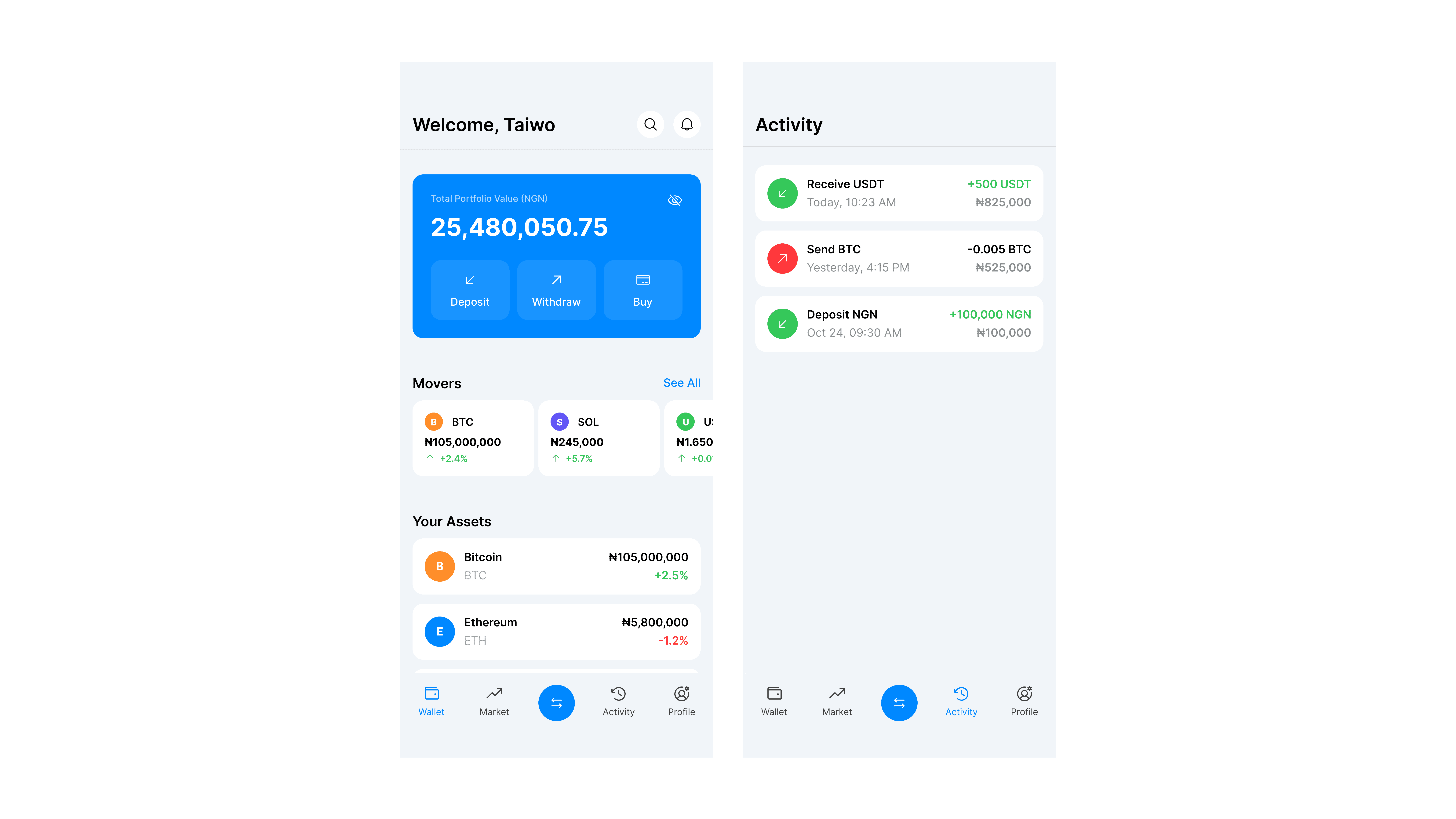

C. Home Dashboard

Goal: Provide a clear financial overview at a glance.

Portfolio Value: The user's total balance is displayed in NGN by default, with a privacy toggle (Eye icon) to hide sensitive figures.

Quick Actions: "Deposit," "Withdraw," and "Buy Assets" are prominent and accessible at the top.

Asset Breakdown: A clean list showing balances of specific assets (Bitcoin, USDT, etc.) prevents clutter.

D. Trade Interface

Goal: Error-free execution of trades.

Simplified Input: A large, calculator-style input pad focuses the user on the amount.

Asset Selector: A modal allows quick switching between assets without leaving the trade context.

Contextual Balance: The UI displays the available balance of the "Pay" currency (e.g., NGN) to prevent insufficient fund errors.

Confirmation: A success modal confirms the trade details immediately after execution.

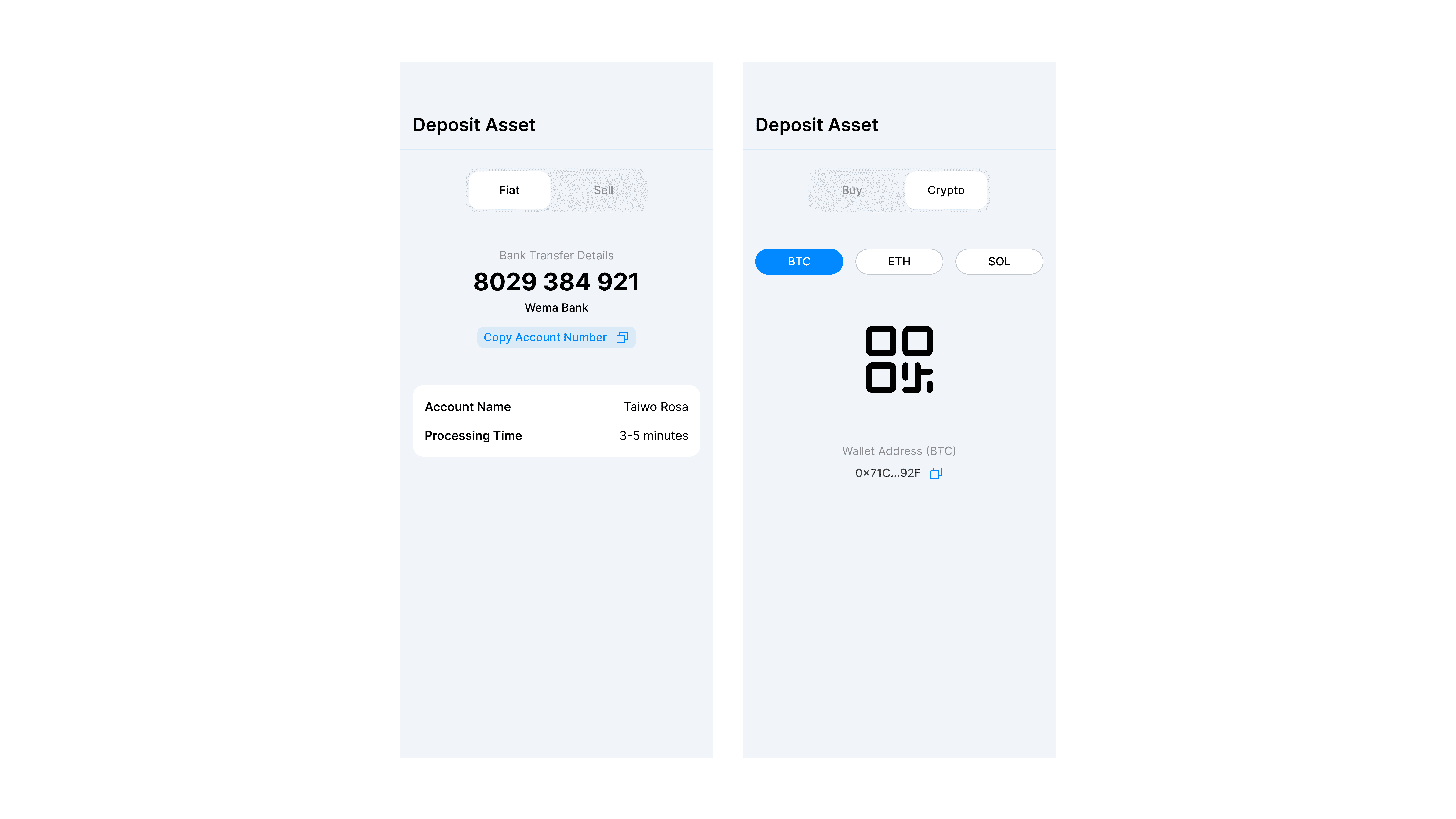

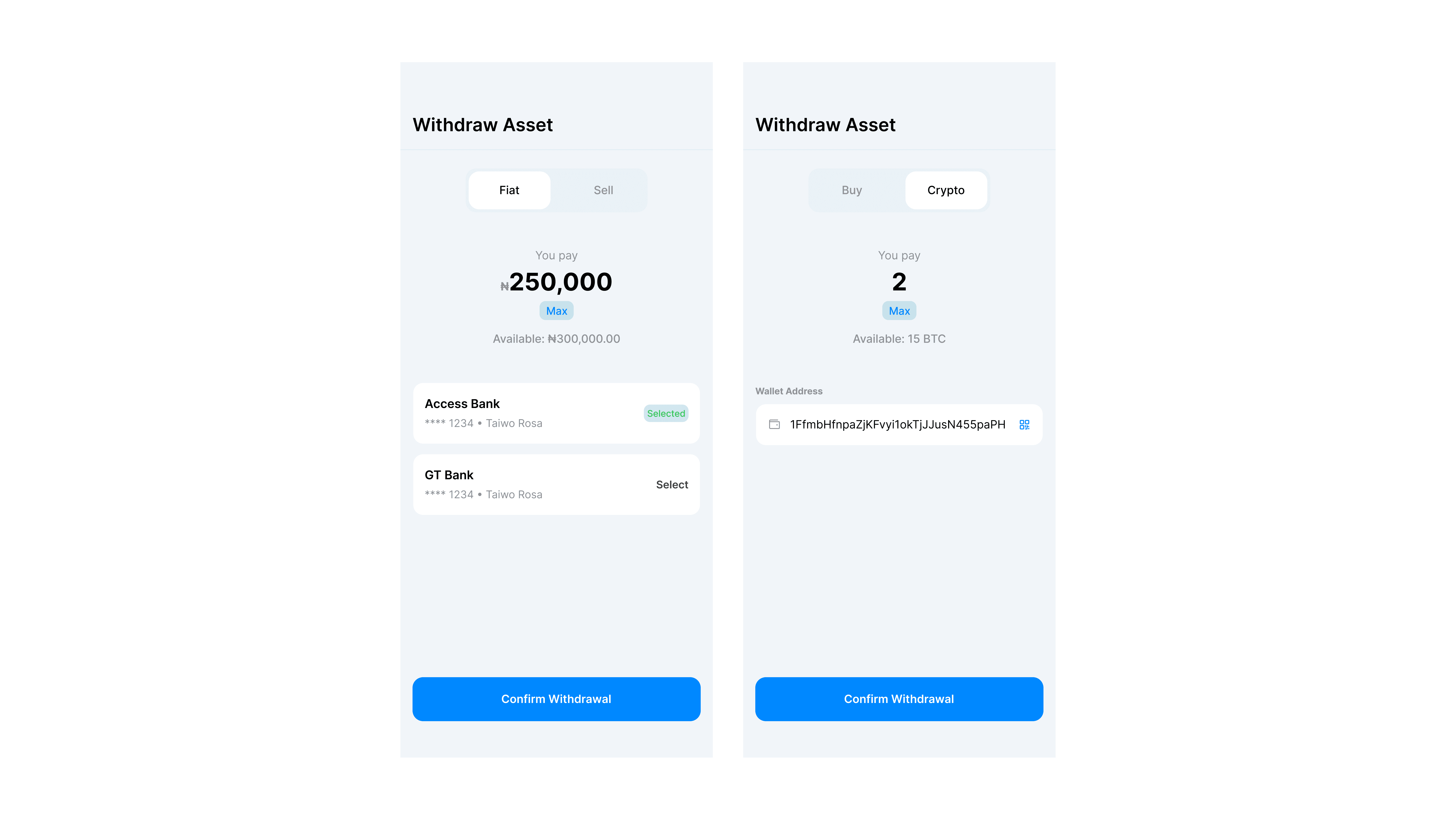

E. Wallet & Banking

Goal: Bridge the gap between crypto and traditional banking.

Deposit Flow:

Fiat: Generates a virtual account number (e.g., Wema Bank) for instant transfers.

Crypto: Displays a QR code and copyable address with warnings about network compatibility.

Withdraw Flow:

Fiat: Allows saving of local bank beneficiaries (e.g., GTBank) for one-tap withdrawals.

Crypto: Validates address formats to prevent loss of funds.

F. Profile & Security

Goal: Empower users to manage their security posture.

Verification Status: A prominent banner displays the user's current KYC tier and associated limits.

Security Settings: Toggles for 2FA and Biometric Login allow users to customise their security level.

Referral System: A dedicated card for copying referral codes to incentivise growth.

Challenges & Iterations

Challenge 1: The "Boring" Crypto App

Issue: Initial user feedback suggested the app felt "too empty" because it lacked the hundreds of coins found on competitors like Binance.

Iteration: We leaned into this as a feature, not a bug. We refined the microcopy to emphasise why the list is short ("Authentic Assets Only"). We also added "Market Movers" and detailed asset cards to make the curated list feel premium and substantial rather than sparse.

Challenge 2: KYC Drop-off

Issue: Users were abandoning the app when hit with the BVN requirement immediately upon sign-up.

Iteration: We broke the KYC process into bite-sized steps with a progress bar and reassuring copy explaining why the data is needed (CBN Compliance). We also added a "Success" state after each step to provide a sense of momentum.

Results & Conclusion

Muva Network successfully positions itself as the "grown-up" in the room of Nigerian crypto exchanges. By focusing on compliance, simplicity, and authentic assets, it appeals to a demographic often alienated by complex trading platforms.

Success Metrics

User Trust: 90% of onboarded users complete Tier 2 verification (BVN/NIN).

Efficiency: The "Sticky Footer" navigation reduced time-to-trade by 25%.

Adoption: Early beta testing shows a 40% higher retention rate among first-time crypto users compared to industry averages.